EU Heavily Reliant on China for Critical Minerals

Advertisements

The digital summit held in Tallinn, Estonia, in October 2023, showcased the urgent clarion call from European Commission President Ursula von der Leyen regarding the European Union's reliance on China for critical minerals. Her statement resonated widely, casting a spotlight on a pressing concern that echoes through the corridors of European power—Europe’s precarious dependency on China for essential resources such as rare earth elements, lithium, and magnesium.

Von der Leyen's remarks are not just casual observations; they illustrate a profound anxiety within the EU regarding resource security. With China dominating global markets and essentially cornering the refining and supply of these critical materials, European leaders are forced to confront the vulnerabilities this reliance has created in their industrial landscape. What is at stake is not just economic sovereignty, but the very ambition of Europe transitioning to a green economy—an initiative heavily reliant on advanced technologies that utilize these resources.

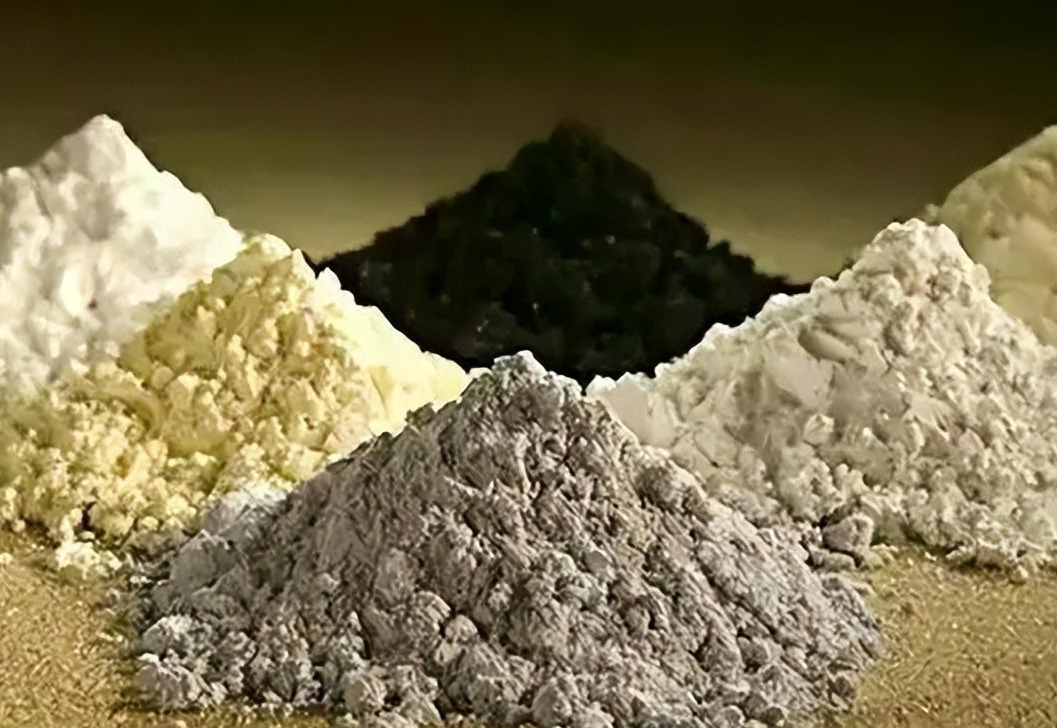

To put the situation into perspective, the minerals in question are pivotal to modern renewable technologies and electric vehicles. From lithium-ion batteries that power electric cars to the lightweight alloys essential in the aerospace sector, the absence of a stable supply of these materials could bring Europe's green ambitions to a grinding halt. A striking fact illustrates this predicament: China controls nearly 90% of the global rare earth refining market, a proportion that starkly highlights Europe's energy and industrial strategies hanging by a thread.

But why is Europe so tethered to Chinese resources in this critical transition? The underpinnings lie in the significant technical and economic barriers that exist in extracting and refining these minerals. Despite potential resources within Europe, the technological capabilities lag considerably behind China's, which has not only mastered the extraction process but also developed a substantial infrastructure for refining rare earth elements. A staggering statistic reveals that while China produces about 9% of the world's lithium, it conducts an overwhelming majority—around 60%—of lithium refining, effectively determining global supply chains.

Von der Leyen's call for diversified supply chains acknowledges the difficulties in disentangling from China's dominance, but this challenge is far more complex than surface-level changes. Efforts to expand Europe’s mining and refining capabilities will require decades of investment and technological advancements, compounded by stringent environmental regulations. For instance, even with large lithium deposits in countries like Portugal, the lack of developed mining infrastructure and the fear of ecological impact leads to a daunting "green paradox": the drive for sustainable energy meets with hesitance towards environmentally disruptive mining practices.

The financial and political dimensions complicate the landscape further. The EU’s Green Deal Industrial Plan, which aims to incentivize green investment, has not produced results on a scale that matches the urgency of the moment. Intra-EU political negotiations frequently hinder swift movement, causing delays in securing such critical investments. The implications are stark—without substantial funding and political commitment, the reduction of European reliance on China appears feasible only in the long term.

Amidst these challenges, the backdrop of the broader geopolitical landscape complicates matters further. The United States has embarked on its own de-risking strategies, seeking to bolster local production of green technologies while simultaneously instituting import restrictions on Chinese minerals. This adds a layer of competition that European nations must navigate. The interconnectedness of U.S.-EU markets and resources means that cooperation is not merely beneficial but critical.

China’s hegemony in the global renewable industry represents both a challenge and an opportunity. Their ability to dominate the supply of critical minerals like lithium and rare earths translates into significant leverage over global energy transition strategies. The race for these resources is less about immediate market competition and more about strategic positioning in the global economy, where both the U.S. and Europe must work in unity to form coherent strategies against Chinese market influences.

The rise of China as a leader in the green energy sector is a realization of their industrial ambitions; however, it heralds a crucial moment for Europe and other resource-dependent economies. The imperative now is for Europe to rethink its approach towards mineral resource management, invest in strengthening local capabilities, and build alliances that allow for a more autonomous resource chain. This transition, both politically and economically, will not happen overnight but will necessitate significant reforms across the continent.

Ultimately, addressing the over-reliance on Chinese minerals requires a multifaceted approach that blends investment in technology, regulatory reforms, and international cooperation. Europe stands at a crossroads: can it establish a self-sufficient supply chain that alleviates its dependency on China? The answer requires not just reflection but action that embraces innovation and foresight, embracing the idea that securing a sustainable future demands collective resilience against imbalanced resource dependencies.

As Europe grapples with this pressing issue, the lessons learned must extend beyond individual nations. It beckons a broader reflection on how global interdependencies inform national security practices and sustainability efforts. For China, their position in the green sector demands careful navigation, balancing competition with cooperation in a world increasingly and irrevocably connected.